Frequently Asked Questions

We require a copy of the Agreement of Purchase and Sale (APS), together with any amendments (Fulfillment of Conditions, change of closing date, etc.). If your not sure what this means, you can ask your real-estate agent to send us the documents directly by email or by fax:

Email: [email protected]

Fax: 519-286-0287

If additional documents are required for your specific transaction, our team will advise you throughout the process and provide you with any assistance you need.

Examples of common additional documents for a sale include a recent mortgage statement and your void cheque for direct deposit of proceeds.

Examples of additional documents for a purchase include your proof of insurance, otherwise known as an insurance binder. We will also need documents to verify your identity.

The main documents that are required for almost every transaction are the Agreement of Purchase and Sale (and any amendments to the Agreement) and two pieces of government issued ID for all parties. Other documents may be required, depending on your specific transaction.

The Law Society of Ontario and all major financial institutions have specific ID requirements to prevent fraudulent transactions. Typically, the requirement is two pieces of valid government issued ID, with at least one of those being a photo ID. A copy of your passport (or PR Card) and driver’s license will typically satisfy all identification requirements.

The Law Society of Ontario and all major financial institutions have specific ID requirements to prevent fraudulent transactions. Two pieces of valid government issued identification are required. One of those pieces of ID needs to have a photo. Passports and Driver’s Licenses are preferred, but we can discuss other options.

The processing of a real estate transaction involves the commissioning of your Affidavit (also known as a declaration). You will need to meet with a lawyer either in-person or by video to create that legal document.

There may be exceptional circumstances where a bank or other lender requires “wet signatures” – if this is the case, or if you simply prefer to an in-person signing appointment, we will make those arrangements accordingly.

At some point we have to meet, either in person or online to complete the purchase or sale.

There may be exceptional circumstances where a bank or other lender requires “wet signatures” – if this is the case, or if you simply prefer to an in-person signing appointment, we will make those arrangements accordingly.

The exchange of funds between law offices typically now occurs electronically, using the large value electronic funds transfer systems, or same-day wire transfers. If you are financing your purchase with a mortgage, the mortgage funds will be sent to our office directly by your bank.

If you are purchasing, you will need to ask your financial institution for a certified cheque or bank draft for the balance due on closing (sometimes referred to as your “down-payment”). We will advise you of the amount of your balance due on closing, which will be payable to Click2Close Professional Corporation, in trust.

You will then need to take that certified cheque or bank draft to the bank and deposit the funds into our trust account. Our trust account details will be provided to you during the closing process, and it is important for you to take a picture of the certified cheque or bank draft, and proof of deposit. We will ask you to provide us with those pictures for verification purposes.

It’s easier than it sounds – we will provide clear instructions to guide you throughout the process.

If you are selling a property, the net proceeds of your sale will be deposited directly into a bank account of your choosing. Most lawyers still require you to pick up a certified cheque from their office, often subject to 5-10 day holds by major financial institutions. With Click2Close, you can expect to have instant access to your sale proceeds, usually on the day of closing.

Funds for the transaction are held in trust by the lawyers and exchanged between the respective real estate lawyers on the closing date.

If you are purchasing, you will be required to provide funds to your real estate lawyer to be held in trust for the closing of your deal. You will ask your financial institution for a certified cheque or bank draft for the amount specified, payable to the lawyer, in our case, to Click2Close Professional Corporation, in trust.

If you are selling a property, the funds will first go to your real estate lawyer who will then transfer the funds to you. Many lawyers still require you to pick up a certified cheque from their office, often subject to 5-10 day holds by major financial institutions. Others, like Click2Close, will direct deposit the funds directly into you account, usually on the day of closing.

The deposit is typically held by sellers’s brokerage (the company the real estate agents work for) or the sellers lawyer in trust, and is credited against the purchase price on closing.

In the event that the transaction does not close, the purchaser’s deposit will not be released to the seller unless the purchaser consents, or by court order.

Just like many other law firms, we charge a flat fee for each transaction. Additional fees are only payable in special circumstances, such as preparing and registering a new mortgage, transferring existing tenancies, making payments to creditors to fulfill mortgage conditions, transferring property through an estate, or preparing and registering a Power of Attorney to complete the transaction.

Click2Close Professional Corporation, like most law firms, will charge a flat fee for the transfer of title and registration of the mortgage(s). There may be additional fees depending on the complexity of the transaction for items like transferring existing tenancies, making payments to creditors to fulfill mortgage conditions, transferring property through an estate, or preparing and registering a Power of Attorney to complete the transaction.

Click2Close Professional Corporation, like most law firms, will charge a flat fee for each transaction. Depending on the situation, there may be additional fees. Examples include preparing a mortgage if not already in place, paying additional creditors if required or preparing and registering a Power of Attorney, disbursements, title insurance and Land Transfer tax.

There are costs and disbursements for all real estate transactions

These costs will appear on a final statement of account and trust ledger.

These costs include title insurance for your property, land transfer tax and realtor commissions, and disbursements. A disbursement is an amount spent by a real estate lawyer on your behalf. Examples of common disbursements include the cost of obtaining parcel registers and other title instruments from the Land Registry Office, and obtaining a tax certificate from your local municipality.

Land Transfer Tax (LTT) is charged by the Government of Ontario on almost every transfer of real property in the province. First time home-buyers may be eligible for a rebate up to $4,000. If you have not had an interest in any property anywhere in the world and you are buying your first property to be your primary residence, you may qualify for a rebate of up to $4,000.00 off the Land Transfer Tax. Ask about this at our initial meeting to see if you qualify.

In some special circumstances, a transaction may be LTT exempt. These special circumstances include transfers pursuant to a separation agreement and transfers among family members. We will advise you as to the LTT status of your transaction.

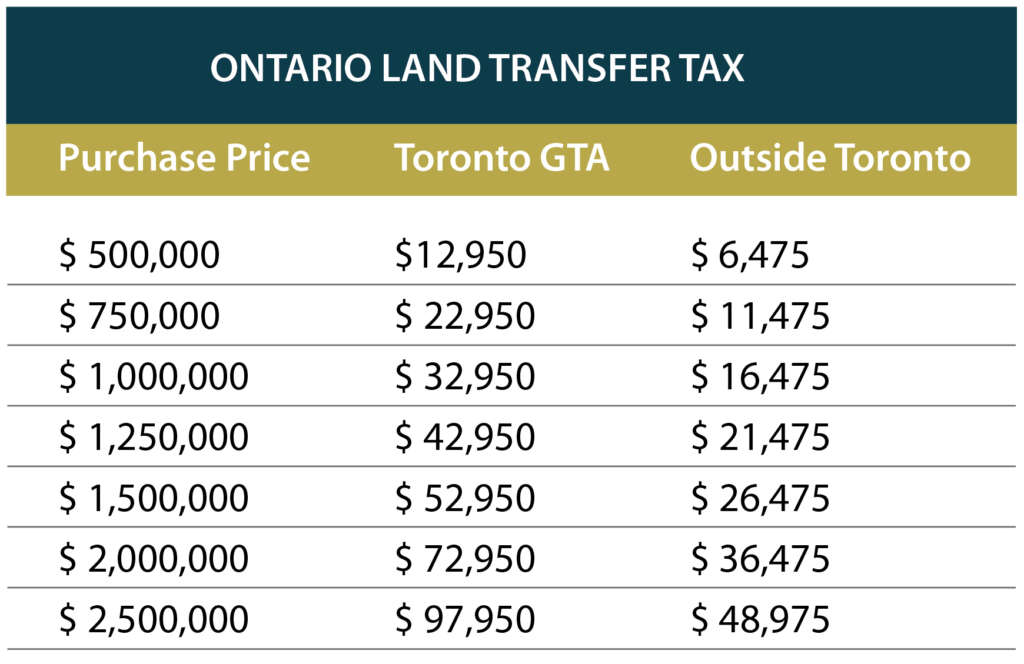

The amount of the Land Transfer Tax that is payable is based on the purchase price of the property. A sample of the amount of tax payable for various purchase prices is in the table below.

The LTT payable, if any, will be included in your balance due on closing.

Land Transfer Tax is a tax charged to the Purchaser of the land by the Province of Ontario every time a parcel of land is transferred, with a few exceptions. The amount of the Land Transfer Tax that is payable is based on the purchase price of the property. A sample of the tax payable for various purchase prices dated is in the table below (2022).

If you have not had an interest in any property anywhere in the world and you are buying your first property to be your primary residence, you may qualify for a rebate of up to $4,000.00 off the Land Transfer Tax. Ask about this at our initial meeting to see if you qualify.

In some special circumstances, a transaction may be LTT exempt. These special circumstances include transfers pursuant to a separation agreement and some transfers among family members.

The closing process normally takes from 2 to 4 weeks, but can happen in less than a week in some situations. This is the time required to establish contact with the other sides lawyer, order, verify, and prepare all the necessary documents, conduct a detailed title search, and obtain the information needed to close the deal. To facilitate this process, we recommend that you provide a copy of your APS at your earliest opportunity.

Pay special attention to two particular dates listed on your APS. The first is the “Title Search” date, the second is the “Closing Date”.

As soon as you send Click2Close your APS, we will track these important dates for you to ensure the smoothest transaction possible.

Keys are typically exchanged through your real estate agent and are held in escrow pending the registration of the transfer.

If you are selling, you will give your agent a single key (or an access code), and leave the rest of the keys on the kitchen counter (mailbox, shed, garage door openers, etc.).

If you are buying, you can obtain a key directly from your agent on the day of closing. Click2Close will contact your agent directly when the transaction has been formally registered, and the key may be released from escrow.

The keys are typically released between 1 – 3pm on the day of closing.

Special instructions will be provided if you are not represented by a real-estate agent.

In the Agreement of Purchase and Sale, you are to receive what is known as “vacant possession” of the property, unless there has been a specific agreement to purchase the property subject to existing tenancies. If the property is not in that condition upon you entering, take pictures of the premises with your cell phone and contact your real estate lawyer as quickly as possible. They will reach out to the Seller through their solicitor to find a resolution.

The condition of home inspection usually includes a clause that the purchaser can “walk away” from the offer to purchase the property and void that transaction at the purchaser’s sole discretion. Depending on the deficiencies, the purchaser and seller may negotiate remedies to any deficiencies.

Although it is easier to ensure a smooth transaction with the “big 5” banks, its generally possible to close through any financial institution which can provide you with either a certified cheque or bank draft and direct deposit information.

No! As long as you can be reached by phone on the day of closing at number you have provided, Click2Close can close the transaction with you being anywhere in the world.

However, the property does have to be in Ontario.

Like any law firm, Click2Close Professional Corporation is subject to the regulations of the Law Society of Ontario including the protections of solicitor/client privilege.

As part of the due diligence in closing the transaction, Click2Close will ensure that the taxes due are properly apportioned and paid by the respective parties based on the closing date. The parties are also responsible to pay their share of utilities, and enforceable obligations to this effect are exchanged as part of the closing process.